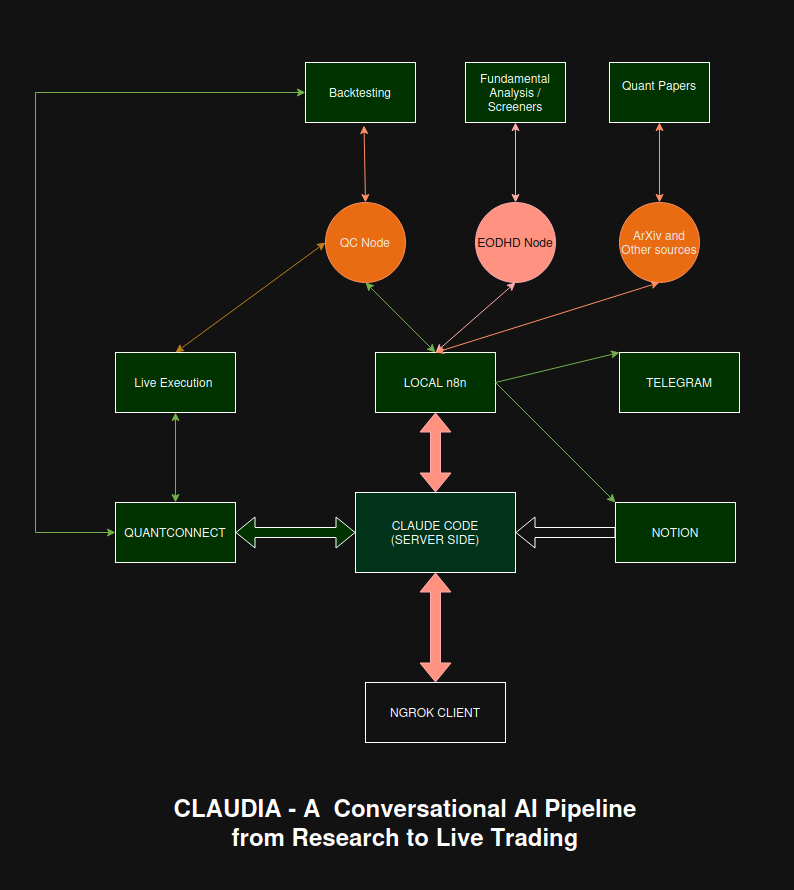

Introducing Claudia: A Conversational AI Architecture from Research to Live Trading

MCP Is All You Need: The Protocol Behind Conversational AI Tooling

Last updated 7th October 2025

Introduction

Artificial intelligence in financial technology is shifting from pure prediction to orchestrated intelligence—systems capable of reasoning, adapting, and executing user-defined goals across integrated workflows. Claudia: A Conversational AI Pipeline from Research to Live Trading introduces a partly self-hosted, modular framework where AI becomes a transparent collaborator in research, backtesting, and live execution.

Claudia embodies the new generation of AI-driven copilot architectures, combining Claude Code with the QuantConnect MCP protocol for natural language control of the entire trading cycle. Unlike institutional AI systems such as LOXM or Goldman Sachs’s quant labs, Claudia prioritizes sovereign, locally controlled deployments—addressing privacy, accountability, and transparent automation.

Backed by n8n orchestration, the system translates natural language into deterministic, reproducible workflows. Every operation—data analysis, signal generation, or deployment—is logged in Notion, ensuring traceability and auditability. The co-pilot model keeps the human user in command, while AI manages coordination and reasoning.

Its self-hosted, modular infrastructure—Dockerized components connected via a secured client-server ngrok tunnel—ensures isolation, scalability, and low-latency performance with minimal reliance on external cloud resources. Claudia’s open-source monetization strategy reflects the developer–operator model: public n8n nodes and integrations, complemented by a paywalled workflow library for advanced tools and deployments.

This white paper is both a roadmap and a transparent update for readers, affiliated companies, and prospective collaborators. It aims to gather feedback to refine the monetization strategy and technical roadmap, transforming conversational, deterministic trading automation into a practical and collaborative project.

This white paper is both a roadmap and a transparent update for readers, affiliated companies, and prospective collaborators. It aims to gather feedback to refine the monetization strategy and technical roadmap, transforming conversational, deterministic trading automation into a practical and collaborative project.

Architecture Overview

This system is a modular, partly self-hosted, containerized environment for modern algorithmic trading, built around a true dialogue between the human user and Claude Code. The workflow enables the user to direct all stages of research, analysis, backtesting, and live trading through natural language—using Claude Sonnet 4.5 coding proficiency, the MCP protocol for QuantConnect integration, n8n for technical analytics, Notion for record-keeping, and EODHD APIs for financial news feed and market monitoring. All automation, orchestration, and notifications are securely managed with docker, ngrok, and Telegram.

Core Components and Human–AI Dialog

1. Human–Claude Code Collaboration (Conversational Control Layer)

The user interacts with Claude Code Server in real time through a secure web client (protected by ngrok, 2FA, and OAuth) to initiate research, ask questions, analyze summaries, and make trading decisions—all in natural language.

For example, after Claude reports:

“Market screening indicates positive sentiment and a potential breakout detected,”

the user can respond:

“Go live on this strategy” or “Show historical win rates for similar signals.”

Claude Code performs conversational reasoning, coding, and strategy review. It handles branching, provides explanations, and supports interactive error recovery.

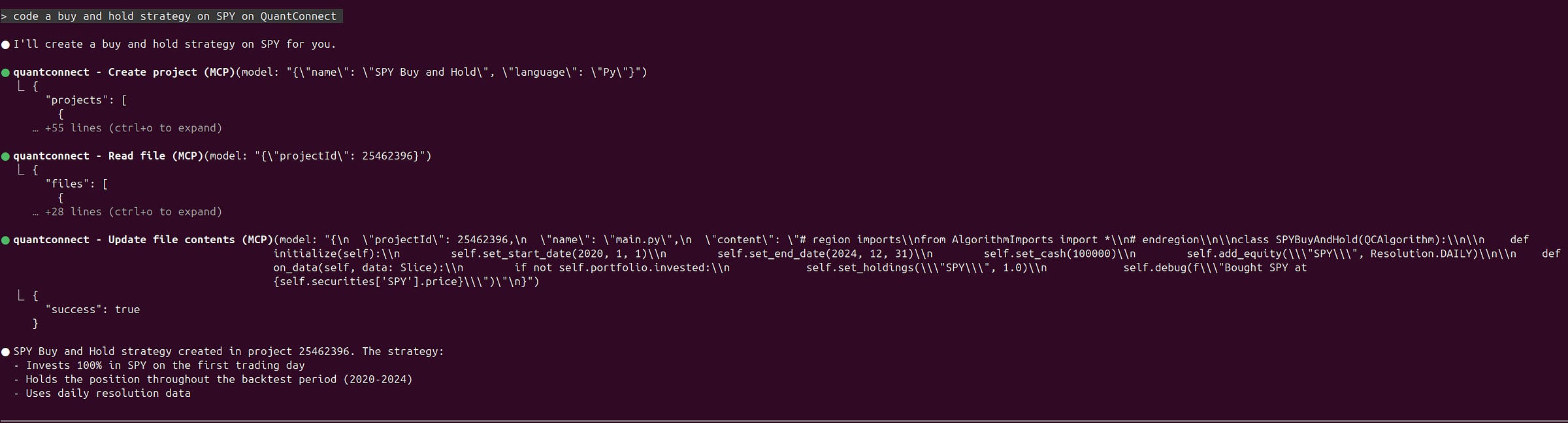

Through the MCP protocol, Claude issues precise commands to QuantConnect to backtest, deploy, or adapt strategies as instructed.

2. Backend Technical Analysis and Research Automation (n8n Layer)

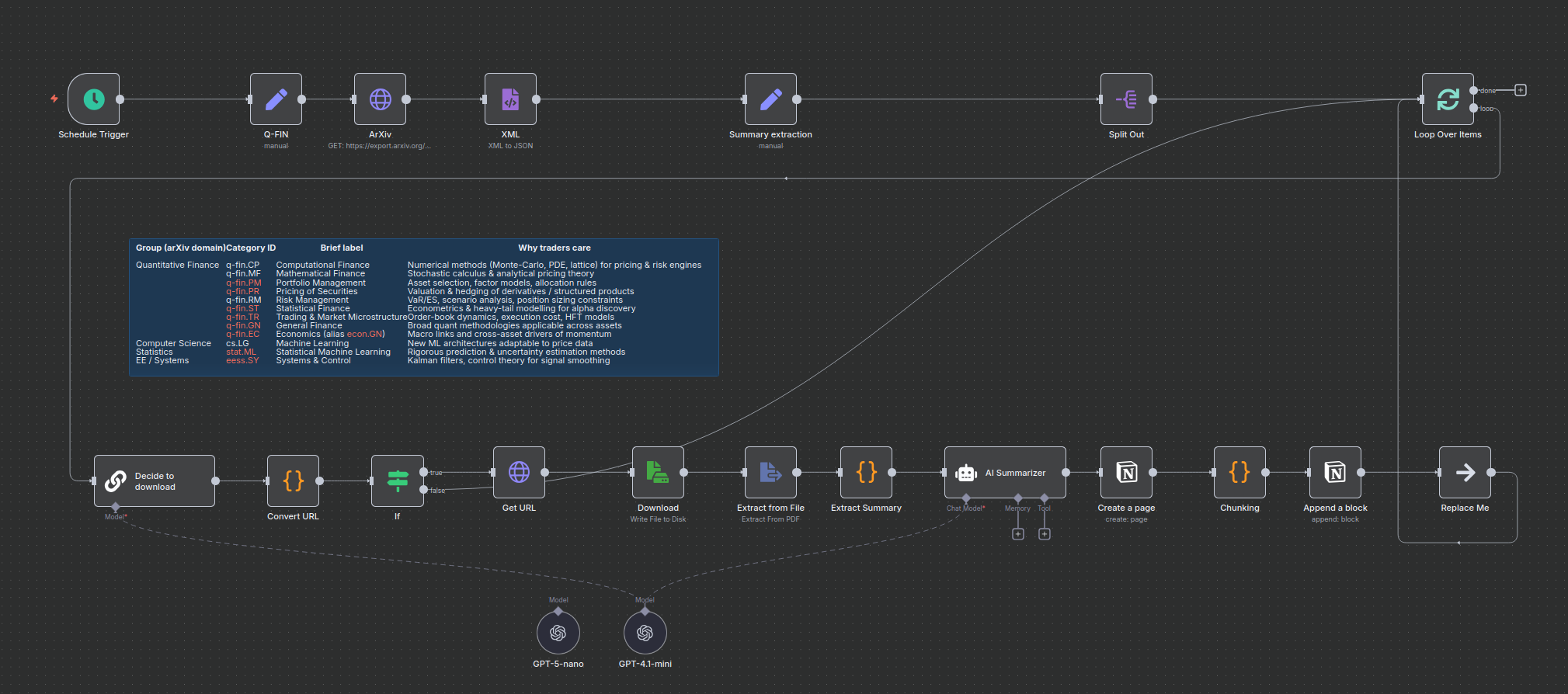

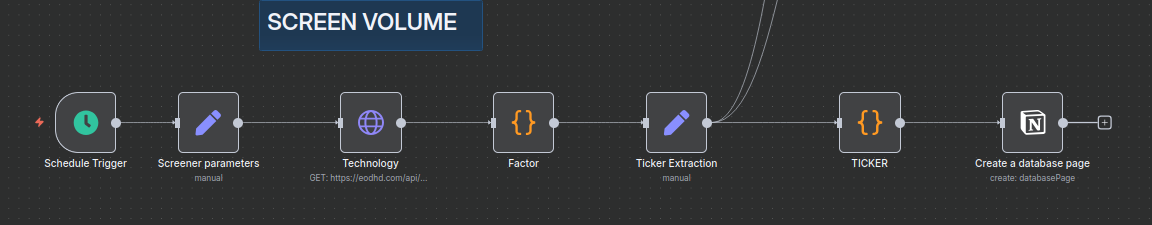

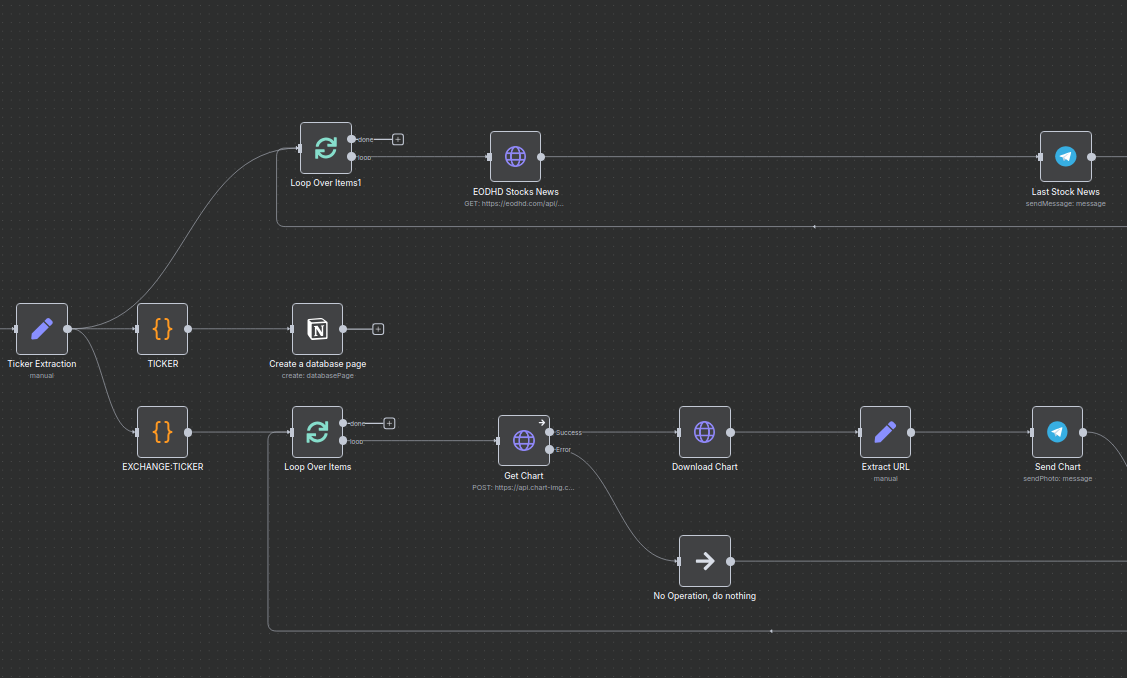

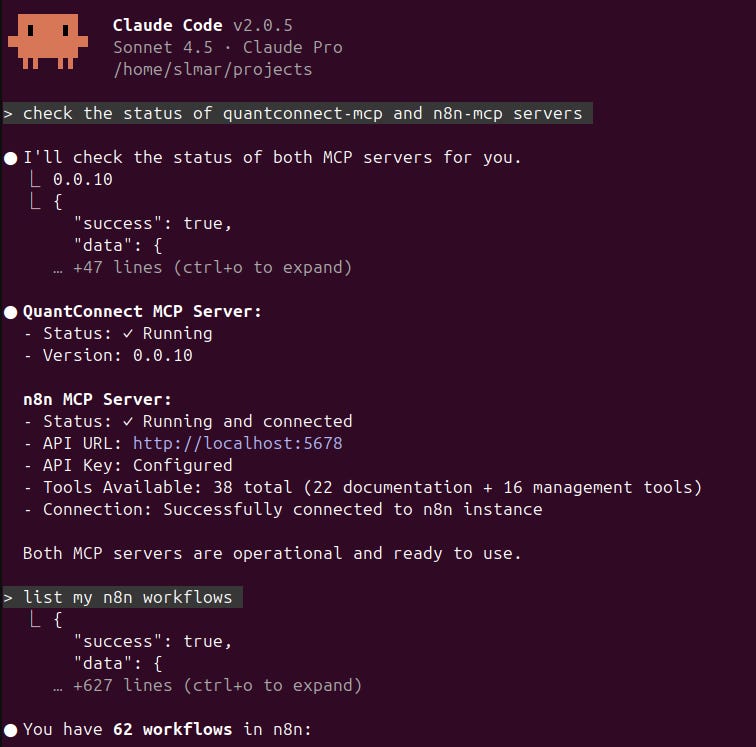

n8n serves as the automation toolbox invoked by Claude Code via the MCP protocol. It hosts AI-powered technical analysis,fundamental metrics analysis, signal detection, screeners, news feed and academic research workflows.

For example, a prompt such as

“Screen for all breakouts in the past week with strong momentum” triggers n8n workflows that access EODHD market APIs, apply AI or indicator logic, and return structured results to the user.

Workflows outputs are sent towards Notion or Telegram. The below example shows an automated research pipeline from the category ‘Q-FIN’ of ArXiv repositories.

3. QuantConnect MCP Integration (Execution Layer)

QuantConnect is a leading quantitative trading platform, used by over 425,000 quants, researchers, and engineers. Claude Code integrates with a containerized QuantConnect MCP server, where natural language commands are translated into structured MCP instructions that create, modify, and manage QuantConnect projects, backtests, optimizations, and live deployments.

When the user says

“Deploy this system live,” Claude orchestrates the code update, deployment, and live monitoring process within QuantConnect.

Demo of QuantConnect MCP with Claude Code by the QuantConnect Team

4. Persistent and Auditable Record-Keeping (Notion Layer)

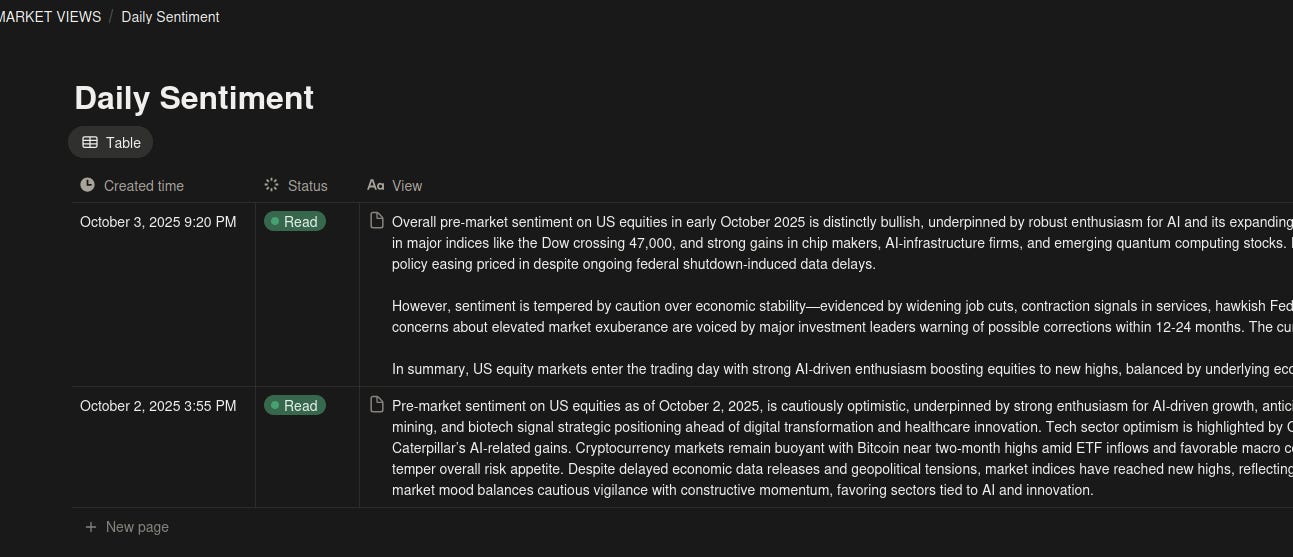

Every research result, configuration, backtest, and live trading event is persistently and automatically recorded in Notion. This provides persistent, structured, and auditable tracking of all operations. Data updates flow from both n8n and Claude Code, either automatically or upon user request.

5. Market Data Feed (EODHD API Layer)

EODHD is a leading financial data provider offering comprehensive coverage across financial news, end-of-day (EOD), intraday, and live market data, as well as fundamental and alternative datasets—spanning the full spectrum of quantitative research needs.

EODHD data is accessed via n8n workflows for screening, analytics, and continuous signal evaluation. Both AI-driven and rule-based engines process this data, enabling delivery real-time summaries and actionable insights to the user through Claude Code.

6. Notification and Remote Operations (Telegram Layer)

A Telegram bot provide real-time notifications at key workflow stages:

Market opportunities detected

Strategy ready for deployment

Live trade started

Anomaly detected

7. Containerization and Secure remote access (Infrastructure Layer)

Each service (Claude Code, n8n, QuantConnect MCP server, ngrok) runs in an isolated Docker container within a private network according to production environment standard. The user-facing endpoint is securely tunneled via ngrok, with strict IP control and authentication protocol.

End-to-End Workflow (Human–AI Dialog in Action)

Dialog Initiation – The user instructs Claude Code:

“Screen for positive sentiment, highlight potential breakouts, and let me know if anything looks actionable.”AI-Powered Analysis – Claude triggers n8n workflows that analyze EODHD data, perform technical and ML-based screening, and return structured findings.

Summary Presentation – Claude summarizes:

“Found three assets with confirmed breakout signals and positive sentiment,”

and suggests next actions.User Decision – The user instructs Claude Code to extend analysis, run backtests, or deploy live.

Live Trading Automation – Claude communicates with QuantConnect via MCP to deploy and monitor the live strategy.

Continuous Feedback – All actions are logged in Notion, and updates are streamed to Telegram. The user may intervene at any point with natural language commands to pause, modify, or terminate workflows.

Current state of the project and updates

In the diagram above, green nodes represent fully implemented or natively operational components. Orange nodes and arrows indicate elements currently under beta testing. The remaining components are yet to be developed — specifically, the n8n–Claude Code connection using the MCP protocol and the ngrok tunneling layer.

6th October 2025 :

Claude Code has now access to the full set of n8n workflows.

Further Development and Specialized Tooling

Ongoing development efforts are centered on building dedicated n8n nodes for QuantConnect and EODHD, designed to power data analytics workflows and function as backend components directly callable by Claude Code.

QuantConnect Node for n8n

Full CRUD operations for algorithmic projects and strategies have been implemented, unit tested, and are now available within n8n. Live deployment features are currently in beta testing, with validation expected to take a few weeks under real market conditions. This n8n node provides a complementary pathway to the MCP pipeline, supporting low-AI or AI-free routines at the data processing level.

At a later stage of the project, derived data flows could also be leveraged to generate Q&A datasets tailored for financial analysis or for fine-tuning pair-coding LLMs.

EODHD Node for n8n

This node is not yet developed, although several data streams are already integrated into workflows via the n8n generic HTTP node. Its purpose is to fetch, preprocess, and deliver market data using a methodology similar to that employed by MarketSenseAI. Given the extensive scope of the EODHD APIs, full development of this node will require additional time.

At a later stage of the project, a derived version of its data flow could be leveraged to generate asset universes and serve as a data acquisition pipeline for the design and training of machine learning forecasting models.

n8n Workflows

A library of n8n workflows is currently in development, covering areas such as fundamental and technical analysis, sentiment analysis, quantitative paper retrieval, and alpha extraction, among others. The publication format is yet to be determined.

Trading strategies library

I plan to resume quantitative research as soon as feasible and publish relevant strategies. The publication format is yet to be determined.

QuantCoderFS

The QuantCoderFS application continues to support manual strategy development. A significant repository update occurred on October 5th, addressing multiple bug fixes and security issues.

The next phase of development will focus on upgrading the underlying LLM to Claude 4.5 Sonnet or another model that surpasses GPT-4.1 in coding performance.

Additionally, I may resume development of the QuantCoder CLI, which has demonstrated stronger interest than the full-stack application. The CLI is lightweight and less AI-dependent, leveraging an efficient NLP pipeline instead.

Financial Visualizations

A TypeScript-based financial visualization frontend, derived from Chat with Fundamentals, is planned for integration with n8n. Since n8n is primarily a backend platform, there is currently no native solution to enable TradingView-like financial visualizations within the data pipeline, which for now relies on the Chart-img API.

Claude persona management

The Claude Code active persona is defined by the claude.md file. Switching between different persona files enables rapid adaptation to specialized workflows, such as serving as a coding assistant for QuantConnect, a fundamental analysis assistant, or a model engineering assistant. Multiple claude.md files can coexist, with persona switching manually triggered by the user.

Acknowledgements

The QuantConnect team has done remarkable work in releasing the MCP server, marking a major milestone for both retail and institutional trading. Disclosure: I am not affiliated with QuantConnect.

The EODHD APIs power several analytical workflows, and I am affiliated with them. If you wish to replicate these workflows, access their data, or eventually implement the full stack described here, you can use this affiliate link, which helps support development at no additional cost to you.

This architecture establishes a transparent, auditable, and conversational trading environment, where natural language control seamlessly interfaces with deterministic automation—combining AI reasoning with human oversight for adaptive, secure, and efficient operations.

Thank you for reading and supporting this initiative.

S.M.Laignel